Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Fed's favorite inflation indicator supports interest rate cuts in September, Tru

- European and American central banks, "to go against each other", the euro rises

- Weekly rebound is coming, gold and silver continue to go long

- 8.21 Gold bottomed out and rebounded and returned to the oscillation zone, selli

- Undercurrents in the euro zone, analysis of short-term trends of spot gold, silv

market news

Daily spindles are under pressure, gold and silver are short and long after short

Wonderful Introduction:

The moon has phases, people have joys and sorrows, whether life has changes, the year has four seasons, after the long night, you can see dawn, suffer pain, you can have happiness, endure the cold winter, you don’t need to lie down, and after all the cold plums, you can look forward to the New Year.

Hello everyone, today XM Foreign Exchange will bring you "[XM official website]: Daily spindles are under pressure, gold and silver are short and short and long". Hope it will be helpful to you! The original content is as follows:

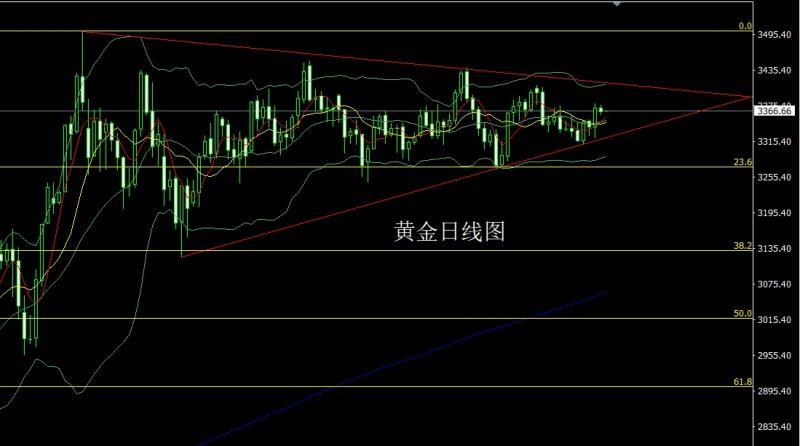

Yesterday, the gold market was consolidated. After the opening at 3371.2 in the morning, the market rose slightly and gave the position of 3372. The market fell rapidly. The daily line was at the lowest point of 3359.5 and then the market fluctuated and rose. The daily line reached the highest point of 3376.4 and then the market fell at the end of the trading session. The daily line finally closed at 3365.5. Then the market ended with a spindle pattern with a lower shadow line slightly longer than the upper shadow line. After the pattern ends, the daily line has certain short-term adjustment pressure. At the point, the long positions of 3325 and 3322 were reduced last Friday and the stop loss followed at 3335. In the morning of today, the short short stop loss was first lifted by 3370. The target below is 3360 and 3355-3352 leaving the market. Today, the lower one gives 3350 more conservative 3348 more stop loss 3344, and the target is 3360 and 367 and 3372-3378

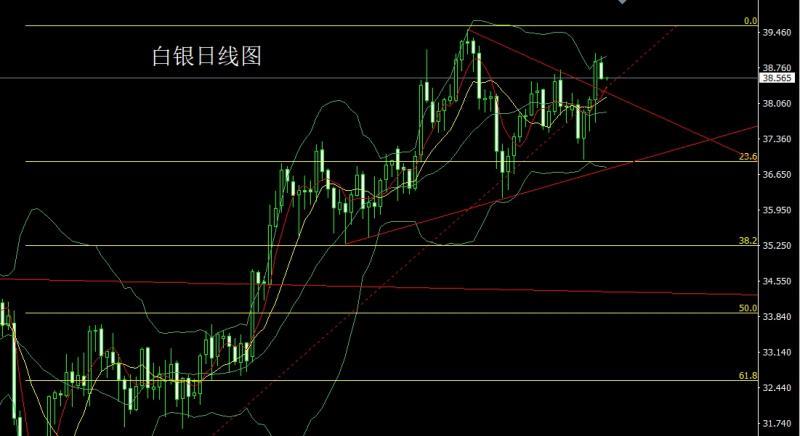

The silver market opened at 38.87 yesterday and then first pulled up to give the daily high of 38.991, and then the market fluctuated strongly. The daily line was given the lowest position of 38.524 and then the market consolidated. After the daily line finally closed at 38.543, the daily line closed with a longer upper shadow line. After this pattern ended, the stop loss was followed by 38.8 last Friday after reducing positions at 37.8. Today's 38.8 short stop loss 39, the target below is 38.5 and 38.35 and 38.2 There are many preparations for departure.

European and American markets opened at 1.17207 yesterday and the market rose slightly. After giving a position of 1.17269, the market fluctuated strongly. The daily line was at the lowest point of 1.16013 and then the market consolidated. The daily line finally closed at 1.16191. Then the daily line closed with a large negative line with a long lower shadow line. After this pattern ended, the daily line was negative and engulfed the signal. Today's market 1.16800 short stop loss 1.17000. The lower target was 1.16000 and 1.15800 and 1.15600-1.15500.

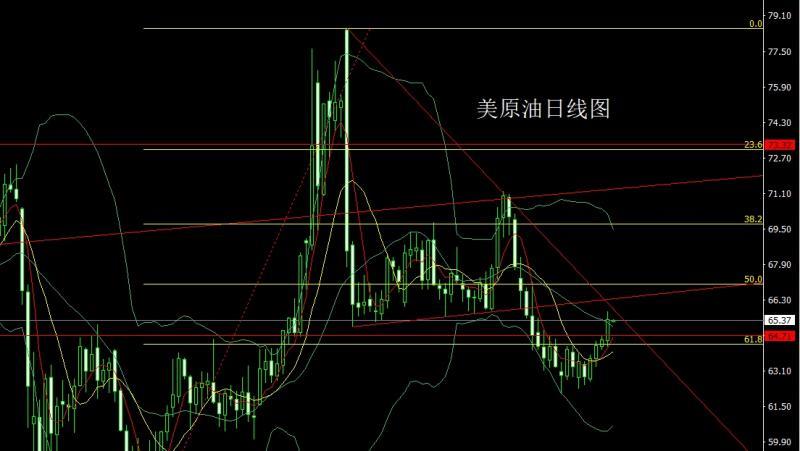

The US crude oil market opened at 64.46 yesterday and then the market fell first. The daily line was at the lowest point of 64.19 and then the market rose strongly. The daily line reached the highest point of 65.76 and then the market consolidated. After the daily line finally closed at 65.41, the daily line closed with a large positive line with an upper and lower shadow line. After this pattern ended, the early trading today first pulled up and gave a short short stop loss of 65.5.85. The lower targets were 65.1 and 64.8.

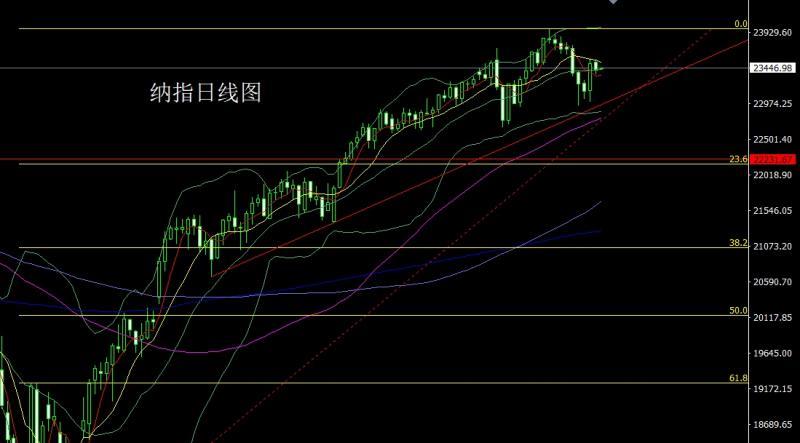

The Nasdaq market opened at 23526.98 yesterday and the market fell first. The daily line was at the lowest point of 23369.13 and then the market rose strongly. The daily line reached the highest point of 23548.58 and then the market consolidated. The daily line finally closed at 23433.93. Then the market closed with a small negative line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, today, the target below 23500 23560 is 23380, 23320 and 23250 left the market and backhanded.

State, yesterday's fundamentals, the US President made another shocking remark, saying that he would cut drug prices by 1,400% to 1,500%; and would quickly impose tariffs on drugs. The Ministry of Defense was renamed the Ministry of War. It is planned to include copper and potassium fertilizers on the list of key minerals. Fed Logan: Banking system reserves still have room for a downward adjustment, and permanent repurchase tools may be launched again in September. Discussion should continue to determine whether the continued www.xmltrust.communication of the federal funds rate target through intervals is still the best choice. Today's fundamentals focus mainly on the monthly rate of durable goods orders in the United States in July at 20:30. Then look at the monthly rate of the FHFA House Price Index in June in the United States and the annual rate of the 20 major cities in June in S&P/CS in the United States. Look at the US August Consultative Conference Consumer Confidence Index and the US August Richmond Fed Manufacturing Index at 22:00 later.

Operation, gold:On Friday, the stop loss followed by the long positions of 3325 and 3322, and the stop loss followed by the 33355-3375. The target of the lower is 3360 and 3355-3352 exit. Today, the lower is given more than 3350 conservative 3348 and 3344. The target is 3360 and 367 and 3372-3378. The target is 3360 and 367 and 3372-3378. The stop loss followed by the 38-holding 37.8 last Friday. Today, the target below 38.8 short stop loss 39 is 38.5, 38.35 and 38.2. The target is ready to leave the market.

Europe and the United States: Today's market 1.16800 short stop loss 1.17000, below the target is 1.16000 and 1.15800 and 1.15600-1.15500 support.

US crude oil: The first pull-up in the morning session today gave a short short stop loss of 65.5 65.85. The lower target is 65.1 and 64.8 and the exit is long.

Nasdaq: Today, the target below 23500 short stop loss 23560 is 23380 and 23320 and 23250.

The above content is all about "[XM official website]: Daily spindles are under pressure, gold and silver are short and short, and they are long after they are short". It was carefully www.xmltrust.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here