Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold, 3400 is close!

- Trump issued another harsh warning to Putin before the meeting, Powell may perso

- Renewed differences in trade between Europe and the United States triggered a se

- The US dollar stabilizes and the Canadian dollar is under pressure, but the futu

- The US dollar's panic pullback is not over. Can the Canadian dollar bulls take o

market analysis

After Powell's stance on cutting interest rates has been clarified, the tone of metal allocation led by gold has changed?

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the ten thousand white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: After Powell's stance on cutting interest rates is clear, will the tone of metal configuration be changed, led by gold?" Hope it will be helpful to you! The original content is as follows:

XM Exchange www.xmltrust.comment: After Powell's stance on interest rate cuts is clear, the tone of metal configuration led by gold has changed?

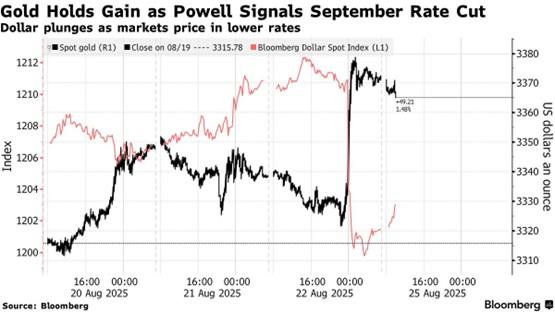

XM www.xmltrust.commentary: Federal Reserve Chairman Powell delivered a speech at Jackson Hall Economics Seminar last Friday, pointing out that labor market risks are rising - although inflation concerns remain. The policy-sensitive two-year Treasury yield plummeted, while the indicators that measure the strength of the dollar fell after Powell's speech, and the U.S. stock market and gold once carnival. On the same day, the Dow Jones Index hit its first record high this year, with gold recording its biggest gain in three weeks, and spot silver rose 1.72% in a single day.

▲XM chart

Powell pointed out that the economic situation has posed "challenges" to Fed officials and stressed that there are still questions about whether Trump's tariffs will re-invigorate inflation in a more lasting way, and he also called the status quo of the labor market "worrying." Therefore, the overall speech is regarded as dovish by the market and further strengthens the market's bet on the rate cut in September and the cumulative rate cut of 50 basis points before the end of the year. However, as U.S. inflation is still above target level and the job market shows signs of weakness, the outlook after September remains highly uncertain.

The gold price has risen more than a quarter this year, with most of the gains occurring in the first four months, thanks to increased geopolitical and trade tensions that have stimulated safe-haven demand and central banks’ purchases. Some market observers, including UBS Group's wealth management unit, expect gold to have room for further growth. However, according to the www.xmltrust.commodity Futures Trading www.xmltrust.commissionThe latest data from the www.xmltrust.committee said hedge funds have cut their bullish gold positions to six-week lows, showing some bullish sentiment fading, temporarily limiting the challenge to the $3,400 mark.

The outlook for silver, which has strong trends this year, remains optimistic, while benefiting from the financial attributes brought about by interest rate cuts and the explosive growth in industrial demand such as photovoltaics. In 2025, its industrial demand may exceed 55%. If interest rate cuts are implemented in September, silver may challenge US$40 per ounce. In the long run, the supply and demand pattern will support the price center to move upward.

In addition to the high prices of precious metals, industrial metals and iron ore prices rose after Powell's speech. Copper prices rose for the third consecutive trading day, with the London Metal Exchange (LME) three-month copper price once hitting its highest since August 14. This year, prices of major industrial metals were restricted due to concerns about weakening demand from the world's largest metal consumers.

There is uncertainty about the sustainability of the copper price rebound, which depends more on the performance of subsequent actual demand. The market tends to balance in the second half of the year, and the amplitude of short-term spot copper prices may expand due to the sway of expected interest rate cuts. Some small metals are expected to have a strong rebound sustainability due to tight supply and demand balance and strategic value.

▲XM chart

Metal investment strategy:

For gold, it can be regarded as the core configuration of economic uncertainty and policy shift periods, focusing on its hedging attributes.

For silver, it can be used as an elastic variety and enjoy the dual pull of financial attributes and industrial needs (especially photovoltaics).

For industrial metals, we need to pay close attention to global macroeconomic data and downstream actual demand verification, and the fluctuations may be large.

For small metals, pay attention to varieties that are supported by tight balance of supply and demand and policy storage, but pay attention to their high volatility.

Overall, the Fed's interest rate cut is itself balancing the upward risks of inflation and the downward risks of employment. If the economy can achieve a soft landing after interest rate cuts, demand for industrial metals is expected to be boosted; if the risk of an economic recession intensifies, its demand will be suppressed, but gold's safe-haven function will be more prominent. As for the impact of tariff policies, imposing tariffs on imported goods will push up inflation, which makes the Federal Reserve more cautious when cutting interest rates. But Powell also suggested that the impact of tariffs on inflation could be one-time, and it might be necessary to adjust the position, and this uncertainty will exacerbate market volatility.

The current market can basically confirm the rate cut in September. All U.S. data (including this week's US PCE price index) will continue to fluctuate the expected rate cut. The current rebound in the metal market caused by the Fed's expectation of interest rate cuts is supported by its reasonable macro logic (monetary policy shifts to expectations, weakening of the US dollar, and strong industrial demand for some varieties). Investors should make differentiated allocations based on their own risk preferences and pay close attention to the clarity of macroeconomic data, Fed policy signals, and key policies.The implementation of governance policies.

The above content is all about "[XM Forex]: After Powell's position on interest rate cuts is clear, the tone of metal configuration led by gold is changed?" is carefully www.xmltrust.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here