Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--EUR/USD Weekly Forecast: Slight Climb Higher as Stable Sentiment Sol

- 【XM Decision Analysis】--FTSE Forecast: Plunges to Test Previous Major Level

- 【XM Decision Analysis】--AUD/USD Forecast: Stabilizes Amid Mixed Signals

- 【XM Market Review】--Dow Jones Forecast: Dow Jones Stabilizes After Volatile Week

- 【XM Market Review】--USD/RUB Analysis: Volatility Not a Coincidence with the Curr

market news

The daily line is 4,000, and gold and silver are closed at a low price.

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: The daily line is 4000 at a high sun, and the gold and silver are at a low low". Hope it will be helpful to you! The original content is as follows:

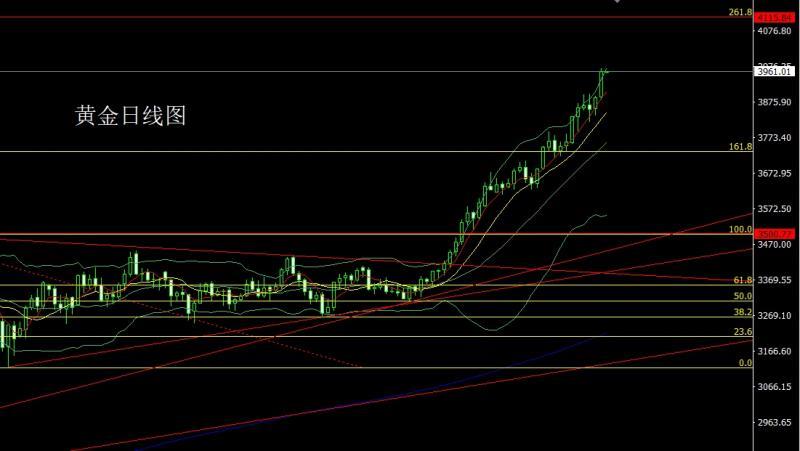

The gold market continued its upward trend yesterday. In the morning, the market opened slightly higher at the position of 3888.8 and then fell back first. The market fluctuated strongly and then rose. After breaking the 3900 integer mark, the market rose strongly. The daily line reached the highest position of 3970.1 and then the market consolidated at the end of the trading session. The daily line finally closed at the position of 3961.1. Then the market closed with a large positive line with an upper shadow line slightly longer than the lower shadow line. This pattern ended. After that, today's market has impacted the expectation of the 4000 integer mark. At the point, the long 3325 and 3322 below are as high as 3368-3370 last week, and the long 3377 and 3385 long and 3563 long and 3563 long and 3650 after reducing positions. After the stop loss is held at 3650. If the market falls back in the morning today, 3946 will be conservative and 3943 will be long and stop loss at 3939. The target is 3965 and 3971. The break is 3976 and 3982 and 3993 and 4000 pressure marks.

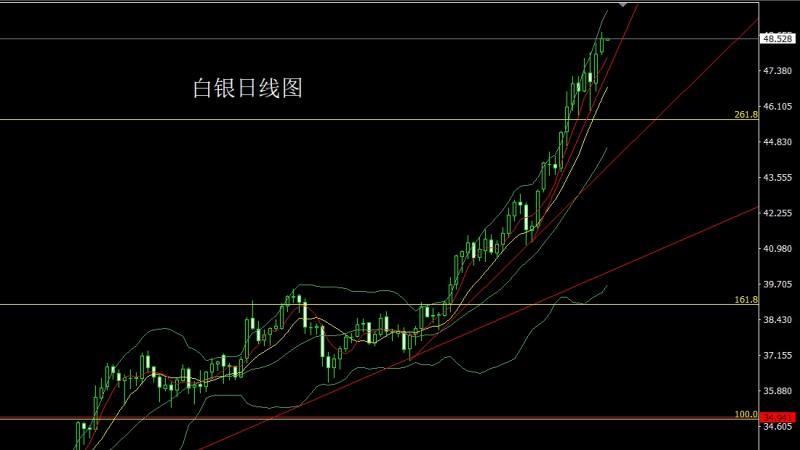

The silver market opened at 48.045 yesterday and the market fell first. The daily line was at the lowest point of 47.928 and then the market rose strongly. The daily line reached the highest point of 48.76 and then the market consolidated. The daily line finally closed at 48.519 and the market closed with a medium-positive line with a slightly longer upper shadow line than the lower shadow line. After this pattern ended, the long position of 37.8 and the long position of 38.8 below were reduced and the stop loss followed up at 4.4 Hold. The stop loss following the 44.6 position reduction after the stop loss is held at 45, today's 48.1 stop loss is 47.9, and the target is 48.5 and 48.8 and 49-49.5.

European and American markets opened slightly lower yesterday at 1.17230, and the market closed at 1.17307, and then the market fell strongly. The daily line was at the lowest point of 1.16507, and the market rose strongly. After the daily line finally closed at 1.17116, the daily line closed with a very long lower shadow line. After this pattern ended, the short selling of 1.17450 last Friday, and the stop loss of 1.16500 today was 1.17000 and 1.17300 and 1.7550 and 1.17750.

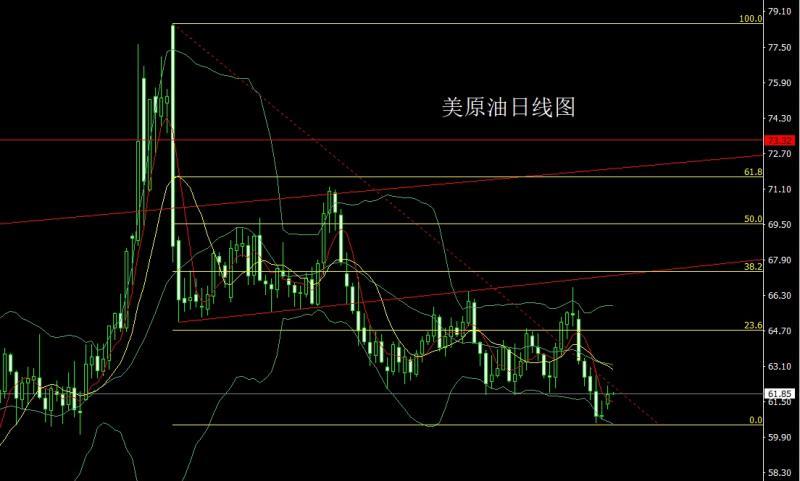

Yesterday, the US crude oil market opened higher at 61.41 in the morning, and the market directly rose. The market fell sharply. The daily line was at the lowest point of 61.13 and then the market rose at the end of the trading session. The daily line finally closed at 61.81 and then the market closed with a medium-positive line with a slightly longer upper shadow line than the lower shadow line. After this pattern ended, the 61.3 long stop loss was 60.8 today, and the target was 62.2 and 62.6 and 63-63.3.

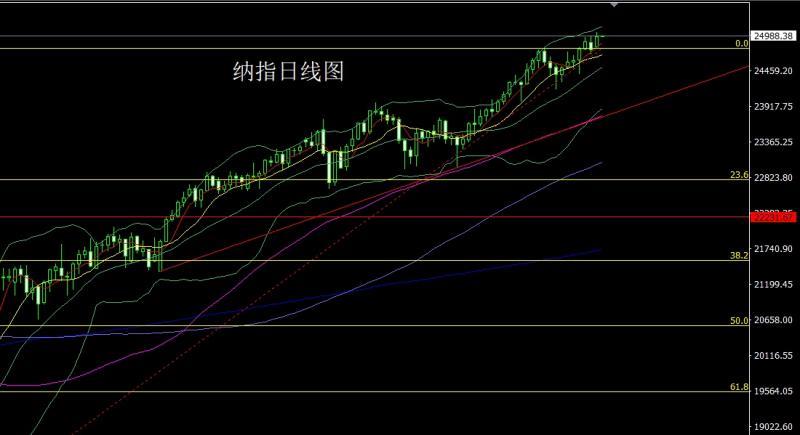

The Nasdaq market opened at 24820.28 yesterday and then the market fell back to 24802.76. The market rose strongly. The daily line reached the highest point of 25045.88. After the market was consolidated. The daily line finally closed at 24971.41. The daily line closed with a medium-positive line with a longer upper shadow line. After this pattern ended, the stop loss of more than 24890 today was 24830. The standard is 24970 and 24050, and the breaking position is 24100 and 24150-24200.

The fundamentals, yesterday's fundamentals have not been released due to the continued shutdown of the US government, and the risk aversion sentiment under this anarchy has been further pushed up, causing the gold, silver and US stock markets to continue to rise and hit new historical heights. Today's fundamentals are mainly focused on the US August trade account at 20:30. Look at the US New York Fed's 1-year inflation expectations in September at 23:00 later.

In terms of operation, gold: 3325 and 3322 long and 3322 below and 3370 long and 3377 and 3385 long and 3563 long and 3563 long and 3650 long and 3650 held. If the market falls in the morning today, 3946 long and 3943 long stop loss 3939, the target is 3965 and 3971. To break the position, look at the www.xmltrust.competition between 3976 and 3982 and 3993 and 4000 pressure points.

Silver: The long position at 37.8 and the long position at 38.8 below will be reduced and the stop loss will be followed up and held at 44. After reducing the long position at 44.6, the stop loss will be followed up at 45. Today, the long position at 48.1 will be stopped at 47.9. The target is 48.5, 48.8 and 49-49.5.

Europe and the United States: The short positions at 1.17450 left the market in early trading last Friday. , today is 1.16700, stop loss is 1.16500, target is 1.17000 and 1.17300, 1.7550 and 1.17750.

U.S. crude oil: today is 61.3, stop loss is 60.8, target is 60.8 Standards are 62.2, 62.6 and 63-63.3.

Nasdaq: Stop loss at 24830 if it is over 24890 today, target 24970 and 24050, and see 24100 and 24150-2420 if the position is broken. 0.

The above content is all about "[XM Foreign Exchange Decision Analysis]: The daily sun is approaching 4000, gold and silver are low and long to be closed". It is carefully www.xmltrust.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Sharing is as simple as a gust of wind can bring refreshing, as pure as a flower can bring fragrance. Gradually my dusty heart opened up, and I understood that sharing is actually as simple as the technology.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here