Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--EUR/USD Forex Signal: Likely to Trade Within Narrow Range

- 【XM Decision Analysis】--USD/TRY Forecast: Steady as Turkey Adjusts Inflation Exp

- 【XM Decision Analysis】--GBP/USD Forecast: British Pound Continues to Consolidate

- 【XM Decision Analysis】--Silver Forecast: Can Silver Overcome $31?

- 【XM Group】--USD/CAD Forecast :US Dollar All Over the Place Against the Canadian

market analysis

The ceasefire in the Middle East reduces risk aversion, and gold and silver take advantage of the situation to make profits

Wonderful introduction:

Optimism is the line of egrets that go straight up to the sky, optimism is the thousands of white sails on the side of the sunken boat, optimism is the luxuriant grass blowing in the wind at the head of Parrot Island, optimism is the little bits of falling red that turn into spring mud to protect the flowers.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market Analysis]: The ceasefire in the Middle East reduces risk aversion, and gold and silver take advantage of the momentum to make profits." Hope this helps you! The original content is as follows:

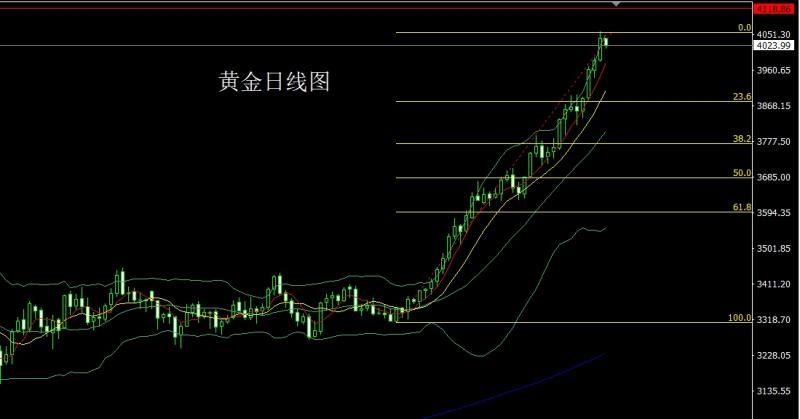

Yesterday, the gold market opened at 3985.2 in early trading, then the market slightly fell back to 3982.5, and then continued the upward trend. After the daily line broke the 4000 integer mark, the market increased. Rapidly rising, the daily line reached a record high of 4059.5 and then the market consolidated. After the daily line finally closed at 4041.4, the daily line closed with a big positive line with a long upper shadow line. After the end of this form , the longs of 3325 and 3322 below and the longs of 3368-3370 last week are www.xmltrust.combined with 3377 and 3385 longs and the longs of 3563. After reducing the position, the stop loss is followed up and held at 3650. In early trading today, it first fell back to 4037 and tried Short, stop loss 4043. The lower targets are 4014, 4000 and 3980 support points. If it falls below, the market will start a short-term profit-taking process. Look at 3940 and 3920.

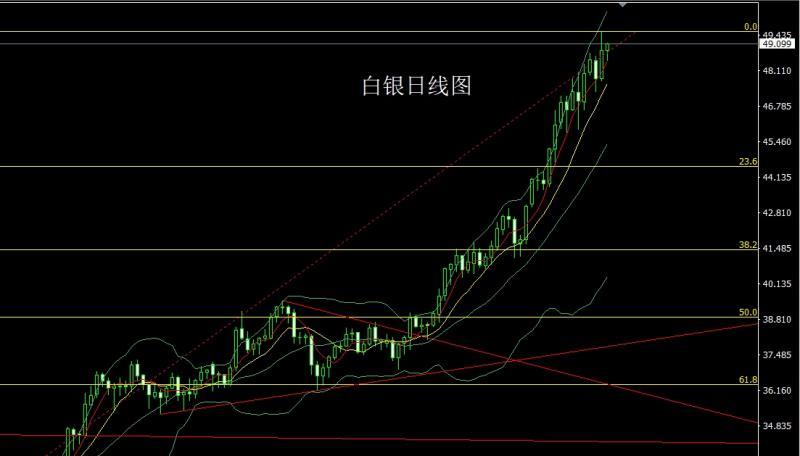

The silver market opened at 47.81 yesterday, then the market slightly fell back to 47.71, and then the market began to rise. The highest daily line touched the position of 49.556, and then the market surged higher and consolidated. , after the daily line finally closed at 48.846, the daily line closed with a Zhongyang line with a long upper shadow line. After the www.xmltrust.completion of this form, the long positions at 37.8 below and the long positions at 38.8 were reduced and the stop loss was followed up at 44. After reducing the long position of 44.6, the stop loss followed up and was held at 45. Today, it first pulled up to give 49.4 and the short short stop loss was 49.6.Target 48.4 and 48-47.7 support levels.

European and American markets opened at 1.16529 yesterday, and the market rose slightly to reach 1.16612, and then the market began to fall. The daily line reached the lowest position of 1.15971, and the market was supported by Fibonacci 38.2 in this round. After the daily line finally closed at 1.16278, The daily line closes with a long lower shadow line. After such a form, the daily line effectively breaks the current trend line support. At the point, today it will first pull up and give 1.16700 short stop loss 1.16900. The lower target is 1.16200 and 1.16000 and 1.15800 and 1.15500.

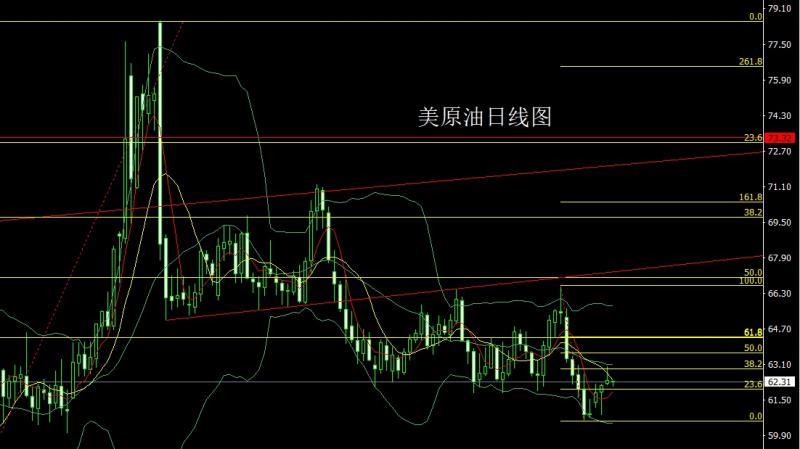

Yesterday, the U.S. crude oil market opened slightly higher in early trading at 62.26. After that, the market slightly filled the gap and reached 62.15, and then the market rose. After the daily line reached the highest position of 63.03, the market came under pressure and consolidated. The hotline finally closed at After reaching the position of 62.37, the daily line closed with an inverted hammer head pattern. After this form ended, the daily line formed a rubbing pattern. Today, 62.8 is short and the stop loss is 63.3. The target below is 62.2, 61.7 and 61.2

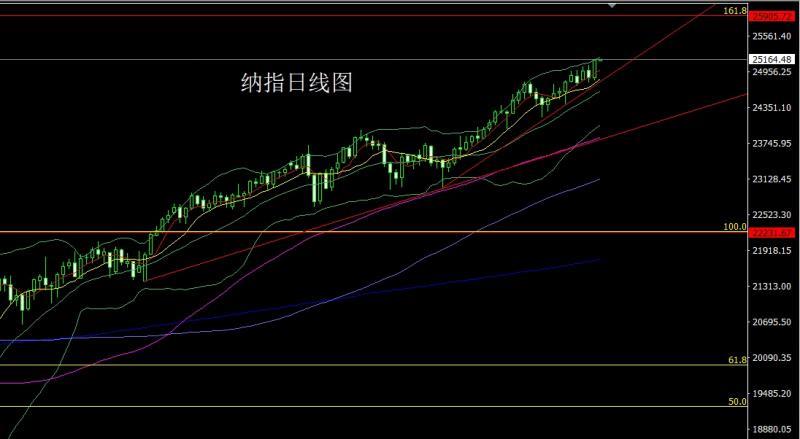

The Nasdaq index opened at 24854.12 yesterday, then the market slightly fell back to the 24821.21 position, and then the market fluctuated strongly and rose, with the daily high touching 2 After the position of 5162.78, the market consolidated. After the daily line finally closed at the position of 25149.41, the daily line closed with a big positive line with a lower shadow line slightly longer than the upper shadow line. After the www.xmltrust.completion of this form , the daily line once again broke through the range and hit a new high. Today's market is over 25030 with a stop loss of 24970. The target is 25150, 25200 and 25300-25360.

Fundamentals, yesterday's fundamentals The market focused on this morning's Federal Reserve interest rate minutes, which showed that when Fed officials approved the first interest rate cut this year last month, there were differences of opinion on how much the subsequent interest rates should be lowered. At the policy meeting on September 16-17, officials generally believed that concerns about slowing employment growth outweighed continued concerns about the stickiness of inflation, and ultimately decided to cut the benchmark interest rate by 25 basis points to a range of 4%-4.25%. The minutes of the meeting showed that most officials believed that "further easing of policy may be appropriate during the remainder of the year." However, some officials still believe that last month's rate cut was not necessary or could have supported keeping interest rates unchanged. Among the 19 officials participating in the meeting, a slim majority expected at least two more interest rate cuts to be carried out this year.This indicates that the Federal Reserve may cut interest rates consecutively at its meetings this month and December. But seven officials still see no need for further rate cuts this year, a stark difference that underscores the tricky situation Chairman Powell faces in building consensus. Some policymakers remain highly vigilant about inflation, which has consistently been above the Fed's target for more than four years. They worry that businesses and consumers may gradually adapt to rising prices, causing inflation to remain at 3% for a long time, well above the 2% policy target. The officials are also cautious about www.xmltrust.committing to more aggressive interest rate cuts as stocks hit new highs. Israel and Hamas have signed a www.xmltrust.comprehensive ceasefire agreement, which will take effect throughout the Gaza Strip at 12:00 Cairo time on Thursday (17:00 Beijing time). The market's risk aversion sentiment has declined to a certain extent, so gold and the US dollar index fell back in late trading. Today's fundamentals focus on the release of the minutes of the European Central Bank's September monetary policy meeting at 19:30. Then look at 20:30 Federal Reserve Chairman Powell’s opening speech at a www.xmltrust.community bank meeting hosted by the Federal Reserve Board of Governors and the number of initial jobless claims in the United States for the week to October 4. Let’s look at the U.S. August wholesale sales monthly rate at 22:00 later.

In terms of operation, gold: The longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563. After reducing the position, the stop loss is followed up and held at 3650. In early trading today, it first fell back to 4037 and tried to go short, with a stop loss of 404. 3. The lower targets are 4014, 4000 and 3980 support points. If it falls below, the market will start a short-term profit-taking process. Look at 3940 and 3920.

Silver: 37.8 longs below and 38.8 longs will reduce their positions and follow up with stop loss at 44. After the long reduction of 44.6, the stop loss follow-up is held at 45. Today, it first pulls up to give 49.4, the short short stop loss is 49.6, and the target is 48.4 and the 48-47.7 support mark.

Europe and the United States: Today, we first pull up and give 1.16700 short stop loss. The lower target of 1.16900 is 1.16200 and 1.16000 and 1.15800 and 1.15500.

U.S. crude oil: Today, 62.8 short stop loss is 63.3. The lower target is 62.2, 61.7 and 61.2

Nasdaq : Today's market price is 25030, stop loss is 24970, and the target is 25150, 25200, and 25300-25360.

The above content is about "[XM Foreign Exchange Market Analysis]: The ceasefire in the Middle East reduces risk, and gold and silver take advantage of the momentum to make profits". It is carefully www.xmltrust.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here