Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--BTC/USD Forex Signal: Eyes $106K Amid Recovery

- 【XM Forex】--USD/SGD Analysis: Reactive Range as Outlooks Suffer Loud Agitation

- 【XM Market Analysis】--USD/CAD Forecast : US Dollar Rallies Against Canadian Doll

- 【XM Forex】--EUR/USD Forex Signal: Pressured Ahead of US Inflation Data

- 【XM Forex】--GBP/USD Forex Signal: Could Rebound as Double-Bottom Forms

market news

The U.S. dollar index fluctuated above the 99 mark, and the Federal Reserve released signals to support the rally.

Wonderful introduction:

The moon waxes and wanes, people have joys and sorrows, life changes, and the year has four seasons. If you survive the long night, you can see the dawn, if you endure the pain, you can have happiness, if you endure the cold winter, you no longer need to hibernate, and after the cold plums have fallen, you can look forward to the new year.

Hello everyone, today XM Forex will bring you "[XM Forex]: The U.S. dollar index fluctuates above the 99 mark, and the Federal Reserve releases signals to support the rally." Hope this helps you! The original content is as follows:

On Friday in Asian trading, the U.S. dollar index hovered above the 99 mark. The yen fell to its lowest level against the U.S. dollar since mid-February on Thursday. Sanae Takaichi, the newly elected chairman of Japan's ruling party, failed to give the market confidence in the direction of the exchange rate. The key release this week will be the University of Michigan (UoM) Consumer Confidence Index for October, due out on Friday. www.xmltrust.composite consumer survey results are expected to decline slightly as ongoing trade war headlines and rising inflationary pressures erode consumer confidence.

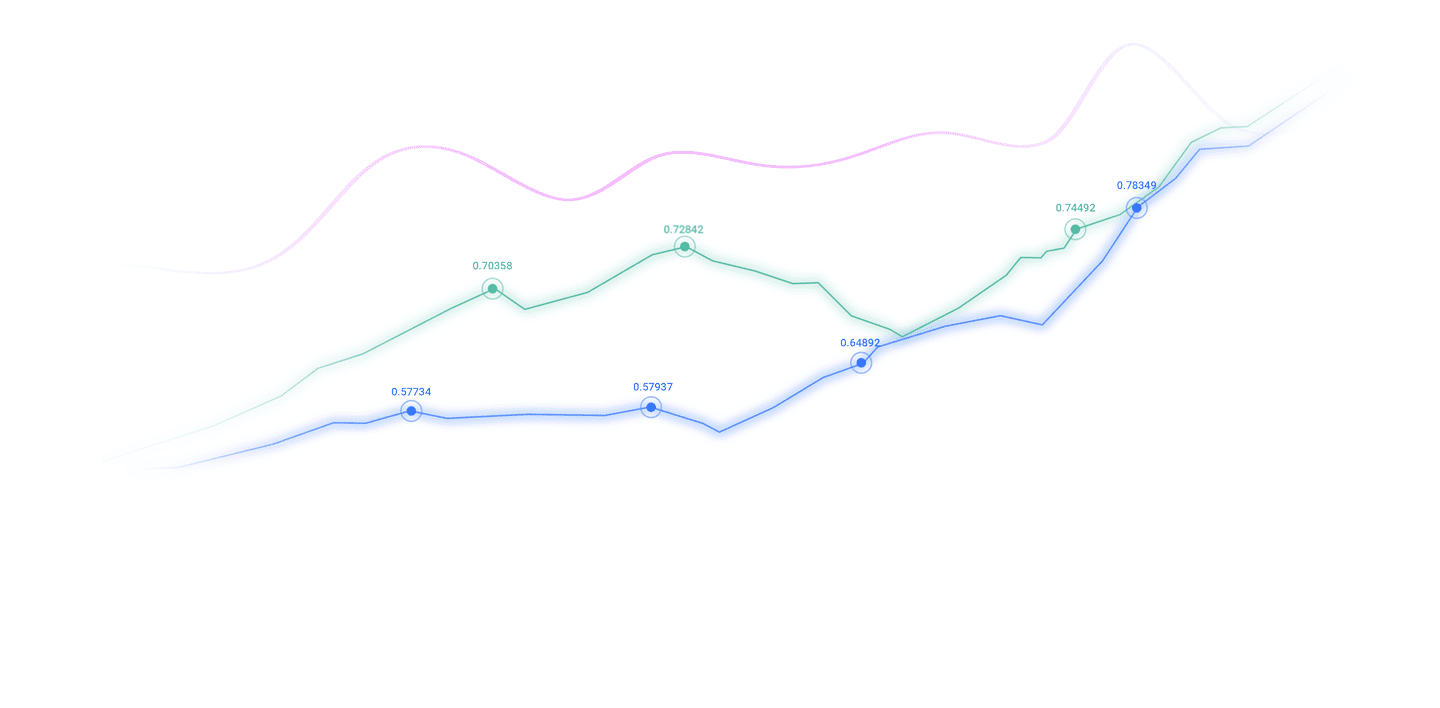

Analysis of major currency trends

U.S. dollar: The strong rebound of the U.S. dollar index is another major driver of gold's decline. On Thursday, the U.S. dollar index rose 0.5%, strengthening for four consecutive trading days. It hit a new high in nearly two months to 99.55, and finally closed at 99.37. The rise directly raises the cost of dollar-denominated gold for overseas buyers, making it less attractive. Technically, with the US dollar index breaking through the 98.834 mark, bulls are currently targeting the high of 100.26 set on August 1. Support lies in the 98.714 to 98.238 range, with stronger buying interest near the 50-day moving average (97.99).

Broad market investor sentiment is beginning to collapse due to the ongoing U.S. government shutdown, with no signs of slowing down. Technically, GBP/USD continued its decline this week, breaking through the recent consolidation range around 1.3400, and is currently testing the 200-day exponential moving average (EMA) around 1.3280. The pair has been under sustained selling pressure as the US dollar regains strength, with a daily close below the 50-day EMA of 1.3467 confirming a shift in short-term momentum towards the bears.

1. The U.S. Senate once again rejected the bipartisan funding bill and Trump threatened to cut Democratic projects

On the 9th local time, the bill proposed by the U.S. Republican Party to end the U.S. government shutdown failed to obtain enough votes in the Senate and the bill was not passed. U.S. President Trump said that day that he planned to cut some federal programs popular with Democrats, given that the U.S. Congress still seems to be deadlocked on reopening the government. Trump said they "will make permanent cuts and they will only cut Democratic programs." Trump has not specified which programs he plans to cut, but he has threatened for days that he would begin massive layoffs if Democrats continued to insist on concessions in exchange for passage of a federal funding bill.

2. ECB meeting minutes: Interest rates are stable and sufficient to cope with shocks

The ECB meeting minutes show that ECB policymakers are in no rush to cut interest rates again, although they are keenly aware of unusually high uncertainties and risks. The European Central Bank kept interest rates steady in September and even gave a mildly optimistic assessment of the euro zone economy, suggesting the bar for further policy easing is high even as U.S. tariffs continue to cloud the outlook. "Given the two-sided risks to inflation and taking into account the full range of possible scenarios, current interest rate levels should be considered sufficiently robust to manage shocks," the meeting minutes said. Since the meeting, the likelihood of further rate cuts has declined further due to relatively benign data and ECB President Christine Lagarde's www.xmltrust.comments that uncertainty around the inflation outlook is narrowing. The minutes of the meeting stated: “The current situation is likely to break out at some point.Significant changes have occurred, but it is currently difficult to determine when and in which direction. The strategy of continuing to wait for more information remains of high value. "However, given the substantial downside risks, the door to further easing is not www.xmltrust.completely closed.

3. French political turmoil drags down the euro

Earlier this week, French Prime Minister Sebastien Lecornu and his cabinet resigned , the euro has since fallen sharply to 1.1546, hitting its lowest level since August 5. The ongoing political deadlock has stalled efforts to reduce the deficit budget, dampening investor confidence. The market is currently waiting for French President Macron's new appointment, which is expected to be announced within 48 hours. Supporting the bullish momentum of the US dollar index.

4. The minutes of the Federal Reserve meeting showed differences on future interest rate cuts

The hawkish tone in the minutes of the Federal Reserve’s September meeting provided support for the US dollar. While officials agreed that a rate cut was necessary given the slowdown in labor market growth, they remained cautious on inflation, reinforcing a "wait and see" stance. New York Fed President John Williams backed further rate cuts and cited risks to employment, but traders have lowered expectations for "multiple cuts." According to CME’s Fed View According to data from monitoring tools, the probability of a 25 basis point interest rate cut at the October meeting is 95%, but the probability of a December rate cut has dropped to 80%.

5. The U.S. government shutdown entered its ninth day, and Treasury bond yields remained stable

U.S. Treasury bond yields did not change much, with the 10-year Treasury bond yield remaining at 4.136%. The U.S. government shutdown has entered its ninth day, a situation that is causing growing concerns among investors. The Internal Revenue Service (IRS) has furloughed more than 34,000 employees this week and the release of key labor market data has been delayed. However, the 10-year Treasury bond auction was successfully www.xmltrust.completed on Wednesday. This is a sign that the current market demand for US Treasury bonds remains unaffected.

Institutional view

1. Mitsubishi UFJ: If France can avoid early elections, the euro may resume its upward trend

Mitsubishi UFJ analysts said in a report that if France restores political stability and does not require new elections, the euro may resume its upward trend against the U.S. dollar. French President Emmanuel Macron is expected to name a new prime minister by Friday following Le Cornu's resignation. Analysts said: “If his efforts to form a government and seek support for the budget fail again, there will be huge pressure to hold another early parliamentary election. "In this case, the euro is likely to remain weak due to political uncertainty, they said. If elections are avoided, the euro is expected to recover before the end of the year.

2. ING: Bond spreads in the euro zone's low-volatility environment are "extremely attractive"

Benjamin Schroeder and Michiel T of INGUKKER said in a report that the low volatility environment in the euro zone government bond market makes current bond yield spreads extremely attractive. The two interest rate strategists pointed out: "In an environment where implied volatility remains low, and considering the European Central Bank's backing, such a spread seems too attractive to miss." According to Tradeweb data, the yield spread between 10-year French government bonds and German Bunds narrowed by about 1.4 basis points to 82 basis points, while the yield spread between 10-year Italian government bonds and German Bunds also tightened by 0.5 basis points, also at 82 basis points.

3. www.xmltrust.commerzbank: Eurozone government bonds are supported and the market remains uneasy

Since an early election in France is most likely to be avoided, eurozone government bonds should continue to be supported, Erik Liem, a strategist at www.xmltrust.commerzbank Research, pointed out in a report. He noted that the macroeconomic calendar is currently quiet, with only Irish government bond auctions. However, "taking a step back, the market presents a www.xmltrust.complex picture," the strategist said. Movements in European equities and a tightening in euro zone government bond spreads suggest that risk sentiment is constructive, however, the widening of credit spreads and the continued strength of German Bunds relative to swaps in recent days underscore that markets remain uneasy and are struggling to take www.xmltrust.comfort from the latest moves.

The above content is all about "[XM Foreign Exchange]: The U.S. dollar index fluctuates above the 99 mark, and the Federal Reserve releases signals to support the rise". It is carefully www.xmltrust.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless or boring, it is as gorgeous as a rainbow. It is this colorful responsibility that creates the wonderful life we have today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here