Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--BTC/USD Forecast: Bitcoin Surges Toward New Highs

- 【XM Forex】--WTI Crude Oil Weekly Forecast: Polite Range Last Week Almost Too Pre

- 【XM Group】--USD/JPY Forecast: US Dollar Continues to Wait for Bank of Japan

- 【XM Group】--ETH/USD Forecast: Ethereum Faces $4K Resistance

- 【XM Group】--USD/MYR: Selling Develops Near-Term as Choppiness Escalates

market news

Confrontation between China and the United States drives risk aversion, gold and silver hit new highs

Wonderful introduction:

Love sometimes does not require the promise of eternal love, but it definitely needs meticulous care and greetings; love sometimes does not need the tragedy of Butterfly Lovers, but it definitely needs the tacit understanding and congeniality of the heart; love sometimes does not need the following of male and female, but it definitely needs the support and understanding of each other.

Hello everyone, today XM Forex will bring you "[XM Group]: Sino-US confrontation pushes for risk aversion, gold and silver hit new highs". Hope this helps you! The original content is as follows:

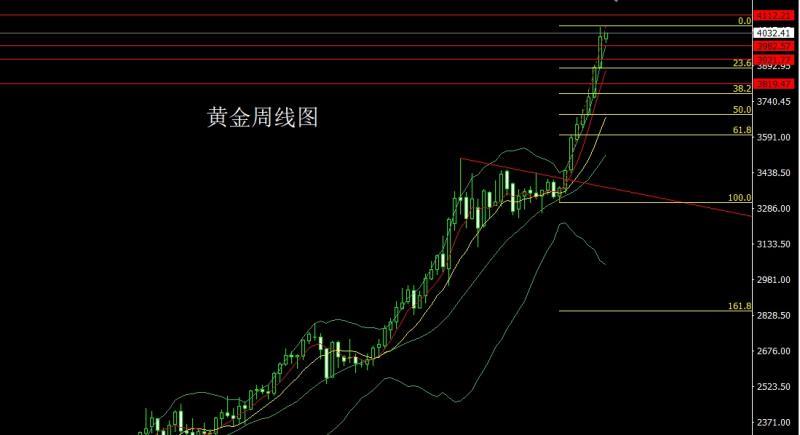

Last week, the gold market continued to rise driven by risk aversion. It opened at 3888.6 at the beginning of the week, then the market retreated slightly to reach 3883.4, and then the market fluctuated strongly and rose. After breaking through multiple pressures, it hit the highest weekly level. After reaching a record high of 4059.7, the market took short-term profits and fell back. On Friday, the market surged again due to the expected image of the escalation of the Sino-US trade war. The weekly line finally closed at 4018.8, and then the weekly line closed with a big positive line with a long upper shadow line. , and after this form ends, the market still technically needs to go higher. In terms of points, the longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377, 3385, and the longs of 3563 will be followed up after reducing positions. 3650 is held, and today it will first pull up and then back off, giving a stop loss of 4020 and 4014. The target is 4045, 4050 and 4055-4060. If the position is broken and driven by risk aversion, there is an expectation of technical pressure hitting 4112-4120 this week.

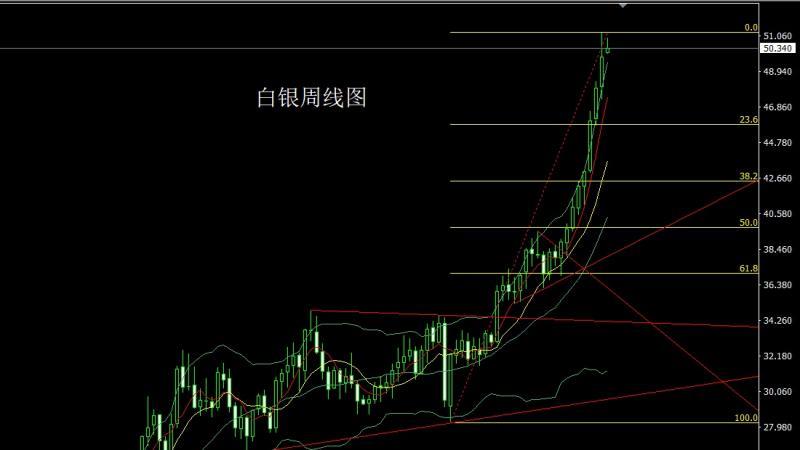

After the silver market opened at 48.043 last week, the market first rose to a position of 48.766 and then quickly fell back. The weekly low reached a position of 47.284, and then the market rose strongly. The weekly high hit a position of 51.266, and then the market surged higher and fell back. The weekly line finally closed.After reaching the position of 49.821, the market closed with a big positive line with the upper shadow line slightly longer than the lower shadow line. After this form ended, the market still had technical bullish demand this week. At the point, the long position below 37.8 and the long position at 38.8 were reduced and the stop loss was followed up at 44. After reducing the long position at 44.6, the stop loss is followed up and held at 45. This week, the high opening is at 50.8. The stop loss is 51.1. The target is 49.6 and 49.2 and 49 and 48.7. Prepare to leave the market long

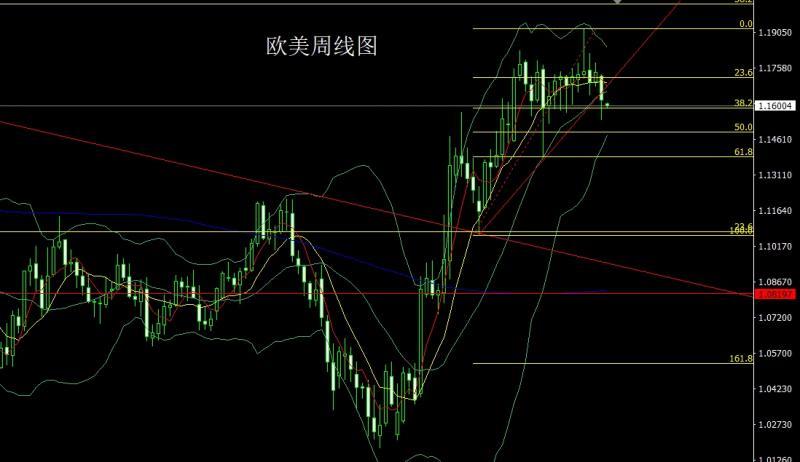

European and American markets opened at 1.17230 last week, and then the market first rose to reach a weekly high of 1.17320, and then fell back strongly. The weekly low reached a position of 1.15404. On Friday, the euro benefited from the impact of the expected Sino-US trade war. , the weekly line finally closed at 1.16245, and then the weekly line closed with a big negative line with a long lower shadow. After finishing in this form, the stop loss is 1.15500 over 1.15700 this week, and the targets are 1.16100, 1.16300, and 1.16500.

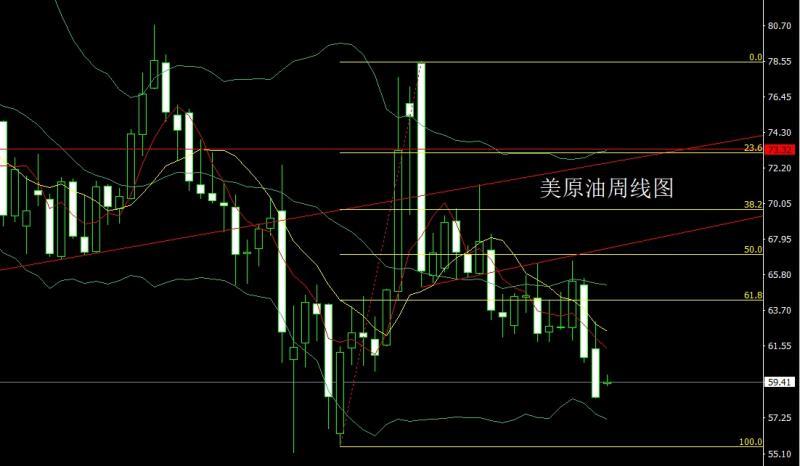

The U.S. crude oil market opened higher last week at 61.4, then fell back to 60.8, and then the market rose strongly. The weekly high hit 63.04, and then the market fell back strongly due to fundamental pressure. The weekly low reached 58.45, and then the market closed. The weekly line ended with a very long upper shadow line. The big Yinxian closes. After this form ends, there will be pressure to continue to fall this week. In terms of points, last week's short position reduction at 62.8 was followed by a stop loss at 62.6. Today's short stop loss at 60.7 is 61.2. The target below is 59.1, 58.45 and 58, and below it is 57.6 and 57.2.

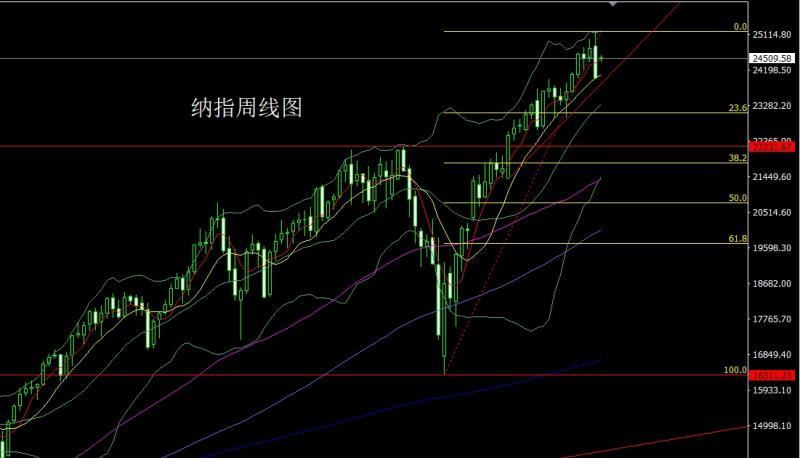

After the Nasdaq opened at 24819.92 last week, the market first rose to a position of 25198.12. Then on Friday, the market was affected by the expected escalation of the Sino-US trade war. The U.S. stock market plummeted, and the weekly low reached a position of 23964.09. After finishing, the weekly line finally closed at 23985.96. The weekly line closed with a big negative line with a long upper shadow line, and like this After the pattern ends, after opening higher this week, a short stop loss of 24770 is given and the target below is 24400, 24300 and 24100-24000.

Fundamentals, last week’s fundamentals, the Ministry of www.xmltrust.commerce of my country issued an announcement announcing the implementation of export controls on overseas rare earth items and rare earth related technologies, and included 14 foreign entities such as anti-drone technology www.xmltrust.companies in the list of unreliable entities. The Ministry of www.xmltrust.commerce and the General Administration of Customs will also issue four announcements in a row, announcing restrictions on superhard materials, some rare earth equipment and raw materials and auxiliaries.Materials, some medium and heavy rare earths, lithium batteries and artificial graphite anode materials and other related items are subject to export controls. Export operators need to apply for a license and indicate item information in the customs declaration form. The announcement will be implemented from November 8, 2025, and aims to safeguard national security and fulfill international obligations. The United States is still in a state of government shutdown. The development of the political situation in France and Japan triggered an atypical risk aversion reaction, and the U.S. dollar, gold and U.S. stocks all surged. Stocks, oil and cryptocurrencies were all experiencing flash crashes into Friday, triggering a rush for U.S. Treasuries and gold. The employment and inflation data that the Federal Reserve relies on for its decision-making were also forced to be postponed. On Friday, the U.S. Bureau of Labor Statistics announced that September CPI inflation data will be postponed to October 24, nine days later than the original date. The Bureau of Labor Statistics said no additional press releases will be rescheduled or produced until normal government services have resumed. Israel and Hamas reach a ceasefire agreement on the first phase of the Gaza conflict. The agreement is the first phase of the US president's 20-point Gaza plan, which calls for Israel to withdraw its troops to "agreed defense lines." Minutes of the Federal Reserve's September meeting revealed significant differences among officials on the path to cutting interest rates. Although most officials support further interest rate cuts during the year, seven officials still believe that no further rate cuts are needed. Only Fed Governor Milan supported a more significant interest rate cut of 50 basis points. Minutes of the meeting showed that officials were generally concerned about slowing employment growth and ultimately decided to cut the benchmark interest rate by 25 basis points to a range of 4%-4.25%. Investors widely expect the Fed to cut interest rates by another 25 basis points at its next meeting on October 28-29, but officials remain cautious about the potential impact of inflation and tariff measures. This week’s fundamentals focus on Monday’s year-on-year electricity consumption in China’s entire society in September. Pay attention to the minutes of the Reserve Bank of Australia's September monetary policy meeting at 8:30 am on Tuesday. At 23:30 in the evening, Federal Reserve Chairman Powell will deliver a speech at an event hosted by the National Association of Business Economics. On Wednesday, focus on China’s September CPI annual rate at 9:30 a.m. This round is expected to be -0.1%. In the evening, watch the U.S. New York Fed Manufacturing Index for October at 20:30. Pay attention to the Federal Reserve's Beige Book of Economic Conditions released at 2:00 a.m. on Thursday. In the evening, look at the US September retail sales monthly rate and US September PPI annual rate at 20:30, as well as the US Philadelphia Fed Manufacturing Index in October. Later, we will look at the 22:00 US October NAHB housing market index and the US August business inventory monthly rate as well as the US initial jobless claims in the week to October 11. However, whether this data can be released depends on whether the US government can end the shutdown. On Friday, focus on EIA crude oil inventories in the United States for the week to October 10 and EIA Cushing, Oklahoma crude oil inventories at 0:00 on Friday. In the evening, look at the annualized total number of new housing starts in the United States in September at 20:30, the total number of building permits in the United States in September, and the monthly rate of the U.S. import price index in September. Later, we will look at the monthly rate of US industrial output in September at 21:15.

In terms of operation, gold: the long of 3325 and 3322 below and the long of 3368-3370 last week and 3377After reducing the long position of 3385 and 3563, the stop loss will be followed up and held at 3650. Today, it will first pull up and then step back to give a stop loss of 4014 for more than 4020. The target is 4045, 4050 and 4055-4060. If the position is broken and driven by risk aversion, there is an expectation of hitting the technical pressure of 4112-4120 this week.

Silver: The long position at 37.8 and the long position at 38.8 below will be reduced and the stop loss will be followed up and held at 44. After reducing the long position at 44.6, the stop loss is followed up and held at 45. This week, it opens high at 50.8, short stop loss, and 51.1. The target is 49.6 and 49.2, 49, and 48.7, and the exit is ready to be long

Europe and the United States: This week, 1.15700 is long, the stop loss is 1.15500, and the target is 1.16100, 1.16300, and 1.16500.

U.S. crude oil: After last week's short position reduction at 62.8, the stop loss follow-up is held at 62.6. Today, the short stop loss of 60.7 is 61.2. The target is 59.1, 58.45 and 58. If it falls below, the target is 57.6 and 57.2. .

The Nasdaq: After opening higher this week, a short stop of 24700 was given, with targets below 24770 looking at 24400, 24300 and 24100-24000.

The above content is about "[XM Group】: The confrontation between China and the United States pushes for risk aversion, and the gold and silver sun reaches new highs. The entire content is carefully www.xmltrust.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and they all stay in my heart forever. Slip away~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here